lifetime pet insurance cat: comparison and results-focused guide

What lifetime cover really means

Lifetime policies aim to fund ongoing conditions year after year, as long as premiums are paid. The annual vet-fee limit resets each renewal. That reset is the quiet engine of flexibility and continuity, giving chronic illnesses a long runway.

How it compares with other policy types

- Lifetime: annual limit renews; one condition can be treated across multiple years. Best for long-term results.

- Max-benefit (per-condition pot): fixed pot per condition; once used, that condition is excluded thereafter. Cheaper at first, rigid later.

- Time-limited: pays for a condition for a set period (often 12 months) from first treatment. Useful for short issues; poor for relapsing diseases.

- Accident-only: lowest price; excludes illness. Minimal flexibility.

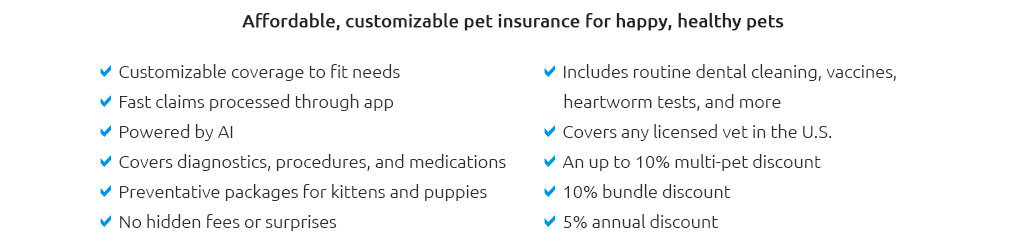

Key features to scrutinize

- Annual vet-fee limit: overall vs per-condition; higher limits help with oncology and orthopedics.

- Co-pay and excess: some add a percentage co-pay after a fixed excess, especially as cats age.

- Chronic cover clarity: diabetes, CKD, hyperthyroidism - confirm no hidden sub-limits.

- Dental illness: often included only with routine dental checks; read the small print.

- Therapies: prescription diet, physiotherapy, behavioral, and alternative therapies - are they covered and to what cap?

- Referral network: freedom to use specialists; ask about direct-to-vet payment.

- Waiting periods: initial days where illness claims aren't covered; accidents may differ.

Result-oriented outcomes you can expect

Strong lifetime cover excels when a condition evolves. Tests today, adjustments next month, and a new plan next year - all under one umbrella. That continuity often yields better clinical results because you aren't forced to halt treatment mid-journey.

Real-world moment

My benchmark: a 6-year-old tabby starts limping after a couch jump. X-rays reveal early arthritis; anti-inflammatories and joint injections follow. The claim goes through in-app; the vet is paid directly. A flare returns the next spring - same policy, renewed limit, treatment continues without budgeting acrobatics. Quiet, predictable, effective.

Where lifetime shines vs where it doesn't

- Shines: breeds with higher genetic risk, outdoor explorers, owners prioritizing therapist referrals and lab work continuity.

- Less ideal: very tight monthly budgets that can't absorb premium rises; older cats with pre-existing conditions already documented.

Price drivers (and why they matter)

- Age and breed: older or pedigree cats cost more to insure.

- Region: urban clinics and referral centers push claims costs - and premiums - up.

- Limit selection: higher annual limits and lower co-pays raise premiums but improve flexibility under pressure.

- Claims history: frequent claims can influence renewal pricing.

Pragmatic caveat

Premiums often rise over time and many insurers introduce a percentage co-pay after a certain age. That's normal, not personal. Budget with a small buffer so the plan remains sustainable.

How to evaluate a lifetime policy (comparison POV)

- Match the annual limit to local treatment costs; ask your vet what a complex year might total.

- Check chronic condition terms for sub-limits and exclusions.

- Confirm direct claims capability with your regular clinic and nearest referral hospital.

- Review the co-pay trajectory by age; model year 3 and year 7 premiums, not just month one.

- Inspect dental illness criteria; many require annual dental checks for coverage.

- Weigh excess vs premium: a slightly higher excess can cut cost without harming outcomes for big claims.

Flexibility in practice

Lifetime cover lets you and your vet pivot: switch medications, try a referral, add physio, repeat imaging, and adjust over time. That flexibility compounds into better result stability, especially for illnesses that don't read the textbook.

Who gets the most value

- Owners who want consistent care paths and minimal interruption between flare-ups.

- Cats predisposed to long-term conditions or those with adventure-heavy routines.

- Households that prefer predictable financial planning over ad-hoc savings scrambles.

Alternatives worth a glance (if it fits)

If your cat is young, strictly indoors, and you maintain a robust emergency fund, a max-benefit plan might be an interim step. Reassess yearly; moving to lifetime before any major diagnosis preserves full flexibility.

Bottom line

For continuity, flexibility, and clinical results that unfold over years rather than weeks, lifetime pet insurance cat cover is the most resilient choice. Price it with eyes open, budget for age-related co-pays, and pick limits that match real treatment costs. Do that, and the policy tends to work quietly in the background - exactly where good insurance belongs.